Why the experts predicted a property plunge – and why they got it wrong

So it seems we swerved the tsunami. The experts unanimously predicted an almighty crash last year. Premonitions varied from the conservative 5% to the Cassandra-like 16% – the house of cards would be brought down by towering mortgage rates and double-digit inflation. A glance at historic house price graphs would convince you that yanking interest rates up from 0.1% to 5%+ would naturally lead to tumbling property values.

But as the smoke clears, we’re currently seeing house prices down just 2.1 per cent in the 12 months to December, according to the ONS Land Registry data for sold prices* – although this does represent the fastest fall for more than a decade.

Now, as our regular readers will know, Land Registry data always comes a month or so behind the announcements from the building societies and estate agents – but since it shows the actual values of houses sold, it’s a more accurate recording of history.

On the other hand, the House Price Indices (HPIs) from Halifax and Nationwide are faster but, less accurate, being based solely on their own respective mortgage approval figures – which completely ignore the fact that 30-40% of house sales are to cash buyers.

And then, of course, the fastest and most up-to-date HPIs are Rightmove and Zoopla – but they’re also the least accurate, with their ‘average house price’ being calculated from the houses listed on their websites. So all it truly tells us is the average asking price.

Source: Nationwide.

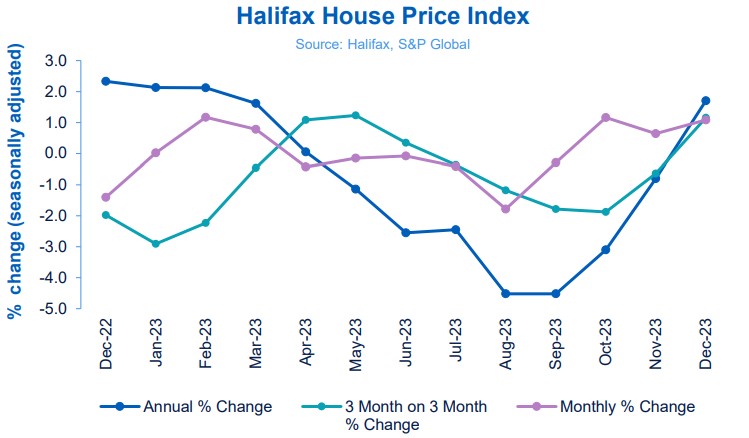

For instance, according to the December House Price Index from Halifax (who actually predicted an 8% drop for the year), property values were up 1.7% on this time last year.

Meanwhile, Nationwide (who predicted a 5% drop) saw a fall of just 1.8% over the year, based on its own lending.

And Zoopla’s latest house price index says prices have fallen by 0.8% on average over the past 12 months – compared with a rise of 6.4% in the year to January 2023.

But surely if the ONS reports on total actual sales, that’s the figure we should believe?

Well, yes and no – and here’s the crucial point – whereas the building societies will report on mortgages they’ve approved from the previous month – e.g. they release November figures in December – the ONS may not report actual completed November sales till February or later – and those will be for sales agreed at least a month prior, but some could be up to six months earlier.

Which means that we can expect a headline in the summer saying “ONS says house prices have risen three months in a row’ – but by then Halifax could easily be reporting a fall based on the previous month’s mortgage figures, and the same week, Rightmove could be recording a jump due to buyer confidence, reflected in today’s asking prices!

So none of the HPIs give us the complete picture. We use Rightmove and Zoopla as barometers of market confidence, then we use the building society figures as a current gauge of where the market is heading, and finally the ONS provides confirmation.

Timeliness of the various House Price Indices in relation to data availability

| Timeliness | House Price Index | Time published after reference period | Stage of recording transaction |

| Most Timely | Rightmove | Published during reference period | Advertised price |

| Nationwide | 1 week | Mortgage Approval | |

| Halifax | 1 week | Mortgage Approval | |

| LSL Acadata | 2-3 weeks (forecast) | Registration of sale | |

| Least Timely | UK HPI | 6 weeks | Registration of sale |

Source: Office for National Statistics, Nationwide, Halifax, LSL Acadata, Rightmove

So those are the price movement figures – but what about the predictions?

Well, the professional forecasts varied almost as widely: Capital Economics premonished a drop of 1.5% and the Office for Budget Responsibility a pessimistic 4.7% – with a further kicker that house prices won’t return to their 2022 peak till the end of 2027.

All, of course, nuances that are lost on the headline writers. On December 15th, The Times ran the headline:

House prices will continue to fall in 2024, say Halifax and Nationwide

Just 18 days later, on 2nd January, the same newspaper ran with the headline:

UK house prices forecast to rise 5% in 2024

…without the slightest nod or blush to the article less than three weeks earlier.

So let’s return Reason to her throne and offer a bit of clarity. The first headline refers to the predictions by Halifax and Nationwide, based on their mortgage approvals so far who apparently feel it in their waters that buyers will feel more confident thanks to the improvement in affordability caused by mortgage rates falling from 5.3% in November to 4% by the end of 2024.

Samuel Tombs, Pantheon’s Chief UK Economist, even went so far as to foresee a double-digit percentage increase in average house prices this year “if buyers were to devote the same amount to mortgage payments as they did in November 2023”.

We’re clearly not in Kansas anymore – and we’re certainly a far cry from the gloomy predictions of a few months ago. The Prophets of Doom – a cynic might call some of them the Profiteers of Doom – are left with quite a bit of foo yung on the old visage after scrambling us all into such a tizz.

So why didn’t house prices fall by more in 2023?

Well, according to Zoopla

1. The strong labour market with the growth in average earnings has bolstered affordability.

2. Lenders have also been more supportive of households struggling with repayments and limited the number of forced sales.

…and crucially…

3. New borrowers have been put through tougher mortgage affordability testing since 2015. Although mortgage rates went as low as 1.3% in 2021, banks required all new mortgage borrowers to prove they could afford to pay 6-7% to get the loan. These new regulations – designed to prevent households taking advantage of low mortgage rates to overstretch themselves – have curtailed housing overvaluation and with households proving more resilient to rising rates.

Another contributing factor was that banks were also restricted to a maximum of 15% of new lending at loan to income ratios over 4.5x income.

We should also point out that, while nominal house prices seemed to have held reasonably firm, the picture is less rosy when adjusted for inflation. In October, the estate agent Savills pointed out that UK house prices have fallen 13.4 per cent in real terms since the March 2022 peak, when inflation is factored in.

What actually happened? – Actual 2023 housing activity in figures

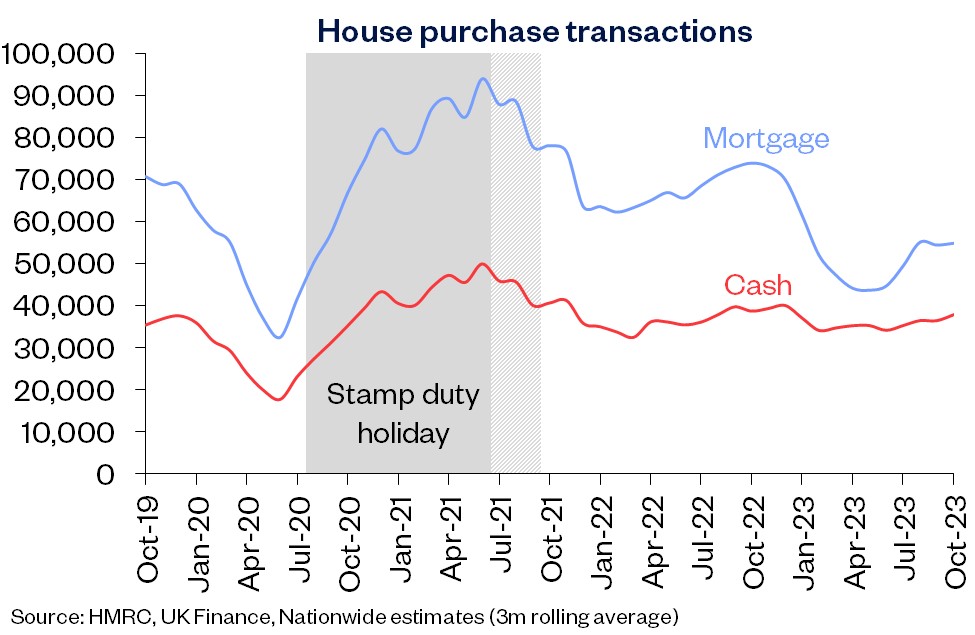

• HMRC Land Registry shows UK home sales fell in November 2023. UK seasonally adjusted (SA) residential transactions in November 2023 totalled 80,780 – down 1.2% from October’s figure of 81,770 (Non-SA down 2.1%). Quarterly SA transactions (September 2023 – November 2023) were around 3.6% lower than the preceding three months (June 2023 – August 2023). Year-on-year SA transactions were 21.5% lower than November 2022 (22.0% lower on a non-SA basis). (Source: HMRC)

• Bank of England’s latest figures show the number of mortgages approved to finance house purchases increased in November 2023, by 4.6% to 50,067. Year-on-year the November figure was 9.9% above November 2022. (Source: Bank of England, seasonally-adjusted figures)

• The RICS Residential Market Survey results for November 2023 point to a somewhat improved outlook. This is a three month rolling average: Each month, a panel of estate agents are asked, “How have average prices changed in the last 3 months? (down/same/up)”, and “How have new buyer enquiries changed over the last month? (down/same/up)”. This month’s survey suggests new buyer enquiries have improved, although they’re still down compared with three months prior. However, in October, prices had been -25% down compared with 3 months prior, and by November they were only down -14%. Which is good news of a sort, and actually the highest since May 2022. Agreed sales also improved to -11% in November (from -23% in October) and new instructions remained steady at -5%. (Source: RICS)

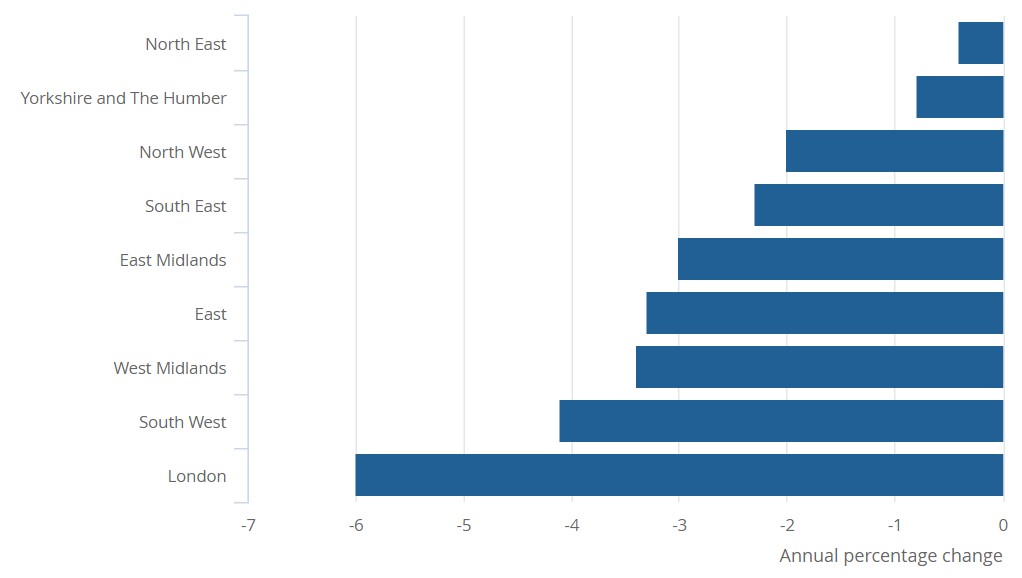

It’s important to note that the headline figures almost always report on average house prices – and there’s no such thing as an average house. The regional figures, for instance, vary wildly, with prices in the West Midlands falling 3.4% and Yorkshire dropping less than 1%.

All English regions saw an annual price fall

All dwellings annual house price percentage change, by English region, 12 months to November 2023

Source: UK House Price Index from the HM Land Registry and Office for National Statistics

Notes:

1. Estimates are not seasonally adjusted.

2. The HMLR’s UK House Price Index (HPI) release on GOV.UK (https://www.gov.uk/government/collections/uk-house-price-index-reports)

In addition, we would normally point out the difference between price changes in new build and existing housing stock. However, due to low build volumes, the ONS has rolled new build figures in with total housing stock and made clear that new build figures may be subject to later revision.

Property price forecasts so far – as at January 2024

(Note: The Office for National Statistics reports on historical figures, but does not forecast – however, other forecasters base their forecasts on ONS statistics, including the Government’s Office for Budget Responsibility)

According to the mortgage lenders…

- 2023 prediction: -5%

- 2024 prediction: Between 0% and -2%

- Average house price: £257,443

Robert Gardner, Nationwide’s Chief Economist, said:

“UK house prices ended 2023 down 1.8% compared with December 2022, leaving them almost 4.5% below the all-time high recorded in late summer 2022. Prices were flat compared with November, after taking account of seasonal effects.

Looking back on 2023

“Housing affordability has remained stretched. A borrower earning the average UK income and buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 38% of take-home pay – well above the long run average of 30%.

“At the same time…a 20% deposit on a typical first-time buyer home equates to c105% of average annual gross income – down from the all-time high of 116% recorded in 2022, but still close to the pre-financial crisis level of 108%.

Where next in 2024?

“Nevertheless, a rapid rebound in activity or house prices in 2024 appears unlikely. While cost-of-living pressures are easing, with the rate of inflation now running below the rate of average wage growth, consumer confidence remains weak and surveyors continue to report subdued levels of new buyer enquiries. Moreover, while markets are projecting that the next Bank Rate move will be down, there are still upward risks to interest rates. Inflation is declining, but measures of domestic price pressures remain far too high.

“It appears likely that a combination of solid income growth, together with modestly lower house prices and mortgage rates, will gradually improve affordability over time, with housing market activity remaining fairly subdued in the interim. If the economy remains sluggish and mortgage rates moderate only gradually, as we expect, house prices are likely to record another small decline or remain broadly flat (perhaps 0 to -2%) over the course of 2024.

“While cost of living pressures are easing, with the rate of inflation now running below the rate of average wage growth, consumer confidence remains weak and surveyors continue to report subdued levels of new buyer inquiries,” Gardner said.

- 2023 prediction: -8%

- 2024 prediction: Between -2% and -4%

- Average House Price as at December 2024: £287,105

Kim Kinnaird, Director, Halifax Mortgages, said:

“In December, the cost of an average UK home rose for the third month in a row to £287,105, up +1.1% or £3,066 in November, reaching the highest level since March 2023.

“The housing market beat expectations in 2023 and grew by +1.7% on an annual basis. The average property price is now £4,800 higher than it was in December 2022. Whilst it’s encouraging that we saw growth in the last three months of the year, this was preceded with property price falls for six consecutive months between April and September. The growth we have seen is likely being driven by a shortage of properties on the market, rather than the strength of buyer demand. That said, with mortgage rates continuing to ease, we may see an increase in confidence from buyers over the coming months.” Across all the UK regions… the South East fell most sharply, houses here now average £376,804 (-4.5%), a drop of £17,755.

“As we move through 2024, the UK property market will continue to reflect the wider economic uncertainty and buyers and sellers are likely to be naturally cautious when considering making a move. While wage growth is now above inflation, helping to ease cost of living pressures for some and improving housing affordability, interest rates are likely to remain elevated for as long as inflation remains markedly above the Bank of England’s target. Our latest forecast suggests house prices could fall between -2% and -4% during the coming year, although, as with recent years, forecast uncertainty remains high given the current economic climate.”

“Overall, with the combination of cost of living pressures and interest rate levels that are still much higher than even two years ago, we will be likely to see continued mild downward pressure on house prices.”

Source: Halifax

So with all that in mind, what’s the prognosis for property prices in 2024? Who’s forecasting what? And what are they basing it on?

According to the property portals…

- 2023 prediction: -2%

- 2024 prediction: -1%

- Average house price: £359,748

Readers will notice that Rightmove’s average house price is wildly different to that of Zoopla (see below), and also those quoted by the building societies. We can only wait and see whether this figure proves to be accurate when ONS sales figures are confirmed in the months to come.

Tim Bannister, Rightmove’s Director of Property Science, said:”

“Tentatively promising new year start as buyer and seller activity jump”

- Average new seller asking prices rise by 1.3% (+£4,571) month-on-month to £359,748, the biggest December to January increase in prices since 2020, though average prices are still 0.7% lower than at this time last year.

- Prices typically rise from a quiet December into a busier January, but this price rise is the largest for January since 2020, and more than double the 20-year average of +0.6%.

- There has been some tentatively promising activity in the first week of the year, markedly stronger than a year ago, as more prospective buyers and sellers seem to have the confidence to get their 2024 moving plans started early.

- The number of new properties coming onto the market for sale is 15% higher than in the same period last year.

- Buyer demand in the first week of 2024 is also 5% higher than in the same period last year. However, competitive pricing from sellers is still vital, with the number of new properties coming to market outpacing the rise in demand.

- The number of sales agreed is 20% higher than during the first week of last year, indicating a strong return of buyer confidence when compared with the unsettled post-mini-Budget period a year ago.

- Since Christmas, Rightmove has seen nine of its ten busiest days on record for people getting a Mortgage in Principle to see what they can afford to borrow, another early sign of movers getting their 2024 plans in place.

- The average 5-year mortgage rate is now 4.86%, compared to 6.11% at the July 2023 peak. While there may be more surprises to come, early indicators suggest a more stable year for the mortgage market after its volatility from September 2022 onward.

- Average new seller asking prices are still 0.7% lower than last year, highlighting that many new sellers are being realistic about their expectations as the market continues to recover from the impact of volatile mortgage rates.

- However, the jump in the number of properties coming to market and the strength of this month’s price rise also show that new sellers are more confident about the outlook for the year ahead.

- There remains no glut of homes for sale, with the total number of available properties just 1% above the more normal market levels of 2019.

- 2023 prediction: -5%

- 2024 prediction: -2%

- Average house price: £264,400

At the end of 2023 Richard Donnell, executive director of research at Zoopla said:

“The final weeks of 2023 have recorded above average levels of new sales, 17% higher than a year ago.

Market sentiment is improving due to rising incomes and an initial decline in mortgage rates. Demand is also 19% higher than a year ago.

An increase in available supply, up a quarter on last year, is also boosting choice and supporting sales. Buyers and sellers are becoming more aligned on pricing, reducing the downward pressure on values.”

‘House prices need to fall further, and incomes increase, or mortgage rates need to fall further to reset affordability and support demand or sales.

‘In Zoopla’s projections, we assume mortgage rates will fall to 4.5 per cent by the end of 2024 and remain at that level into 2025.

‘The number of homes for sale is at a six-year high, meaning sellers will need to price competitively if they are serious about selling. This is likely to keep pricing under pressure.

‘Faster growth in household incomes in 2024 will support affordability but leave housing slightly overvalued at the end of 2024.

‘Households taking longer mortgage terms would remove this overvaluation. The outlook really hinges on the trajectory for mortgage rates and how lenders assess affordability over 2024.’

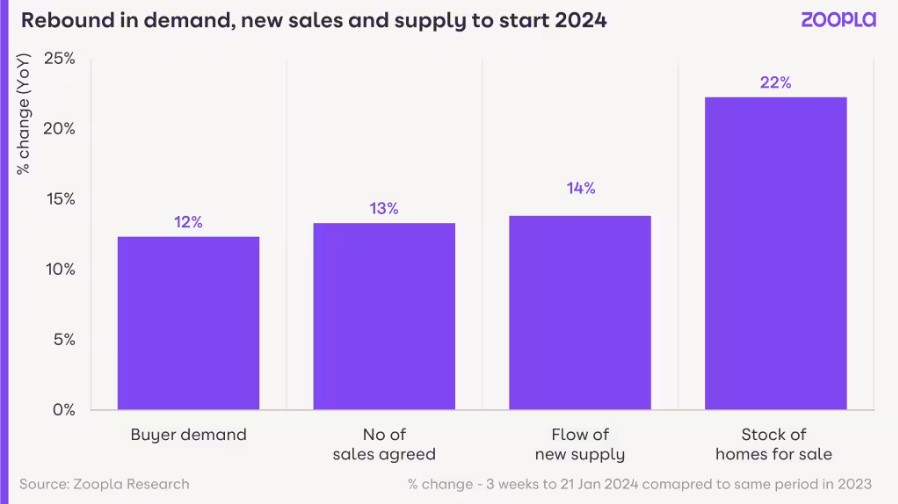

Since then, Zoopla has updated its predictions, having seen more optimistic January figures.

Key points:

Pace of annual house price falls slows

- House prices continue to adjust to higher mortgage rates through modest price falls. However, price falls are slowing as more sales are agreed at the start of 2024.

- House prices have fallen -0.8% in the year to December 2023, compared to a -1.4% fall in the year to October 2023.

- The largest price falls are in the East of England (-2.5%) and the South West (-2.2%). Northern Ireland is an outlier with house prices up 3.2% over 2023.There is a supply glut: The number of homes available for sale is at a six year high -34% more homes for sale now compared to a year ago

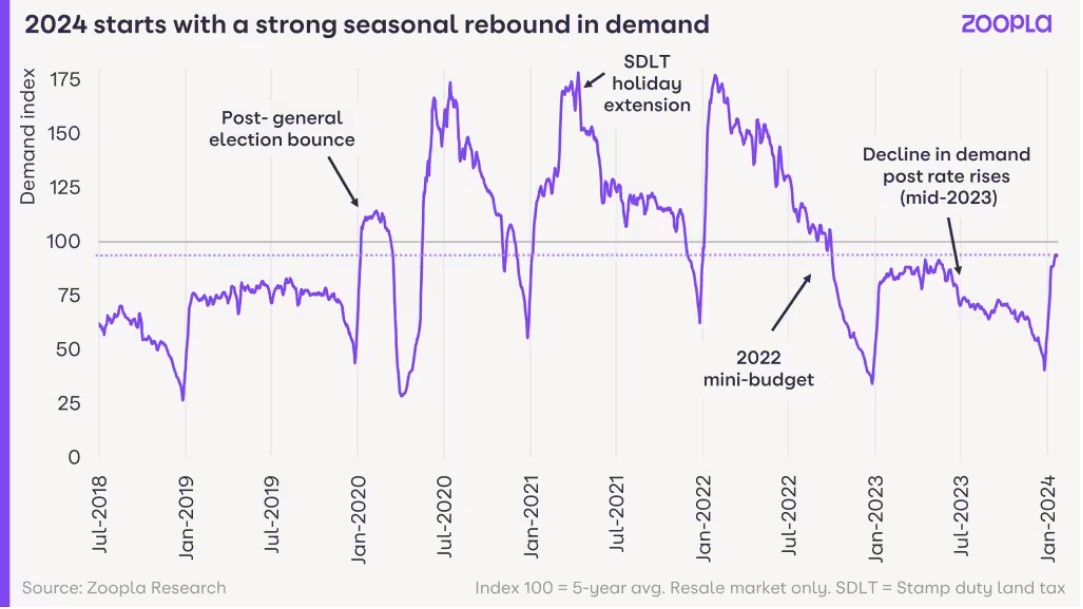

- There has been a strong seasonal uplift in buyer demand in the first 3 weeks of 2024.

Buyer demand rises at the start of 2024

- Sub-5% mortgage rates mean buyer demand is sitting 12% higher than a year ago, although still 13% below the 5-year average.

- This reflects a return of pent-up buyer demand following a weak second half of 2023. Many buyers delayed moving in the face of rising mortgage rates.

All measures of housing market activity are up year-on-year.

The uplift in agreed sales in the final weeks of 2023 has continued into 2024. This suggests buyers and sellers are becoming more aligned on pricing after over a year of tussling.

New sales are 13% higher than a year ago and up across all countries and regions, most markedly in Yorkshire and the Humber (+19%) and the West Midlands (+17%).

There’s also been a 22% uplift in the flow of homes listed for sale. This indicates that people are feeling more confident in listing their home for sale again, boosting choice for buyers and keeping prices in check.

BUT…

Let’s not get carried away: we’re still in a buyers’ market.

It’s good to see renewed activity in the market but it’s important not to over-interpret what this might mean for 2024.

Last year, mortgage rates fell to 4.2% in the first 3 months of the year, which supported sales volumes and led to only modest price falls.

We expect current mortgage rates to have the same effect this year, supporting sales volumes rather than hugely impacting house prices.

House prices will be kept in check by several factors:

- A greater supply of homes for sale giving buyers more choice, especially for larger family homes.

- Half of those with a mortgage are yet to refinance onto a higher mortgage rate, keeping people price-sensitive and focused on value when they move house.

- A small but not insignificant number of sellers cutting their asking prices to attract interest, continuing this 2023 trend.

- 1 in 5 sellers accepting more than 10% off the asking price, and close to 1 in 4 across London and the South East.

- It seems unlikely that mortgage rates will fall much further in the near term, remaining in the 4% to 5% range and the best deals for big deposits.

- Lower mortgage rates are welcome news but will support sales rather than price rises in 2024.

According to the estate agents…

- 2023 prediction: -10%

- 2024 prediction: -3%

- Mainstream house prices to return to growth by 2025

Lucian Cook, Head of Residential Research, said:

“The robust mortgage regulations introduced in 2014 will mitigate risks to some degree. When this mortgage regulation was introduced, many considered it draconian. With the benefit of hindsight, it looks positively visionary.”

Forecasts (based on figures from Oxford Economics):

- UK house prices will ‘bottom out’ next year, falling by 3%

- Cost pressures and higher mortgage rates have dampened the housing market this year, but borrowing costs will ease in the second half of 2024.

- The estate agent said the market was past ‘peak pain’ and that house prices had held up slightly better than expected in 2023.

- Property transactions are expected to remain at around 1 million in 2024.

- Buy-to-let in the North West tipped one of the top two performing sub-sectors next year

- Despite tougher conditions for landlords, with Savills forecasting rents to grow by a further 18.1% by 2028 there is still significant opportunity for those less reliant on debt, particularly for those with a portfolio furthest from London, with Savills forecasting 9.2% returns for the North West.

- Struggles in the private rented sector are also expected to spur institutional landlords to consider both Build to Rent and Purpose Built Student Accommodation

Savills’ residential predictions and top picks for 2024:

- Even though costs of debt are expected to stay “higher for longer”, progressive cuts in the cost of mortgage debt over the next five years should open up capacity for a return to house price growth and an increase in activity levels.

- The prospect of a more widespread recovery in market conditions will come as welcome news to a housebuilding industry, which has been at the sharp end of the housing market downturn of the past year. Coinciding with the cessation of Help to Buy, substantial increase in build costs and a substantial shift in planning policy this has been a bruising experience.

- Buoyed by a burst of strong rental growth, larger equity-rich landlords have been much better placed to weather the storm, being able to take a more sanguine view on the impact of the end of the Assured Shorthold across a portfolio which diversifies tenant specific risks.

- But the benefits to developers of selling built-to-order units off-plan (post Help to Buy), looks more conducive to the process of assembling portfolios of energy-efficient, new-build residential homes than ever.

- Top picks:

- Best in Class: Whenever a market is in the late stages of a downturn or the early stages of a recovery, it’s the properties that are Best in Class that perform most strongly. It’s a combination of location, situation, aesthetics and quality of accommodation. Difficult to describe but you know it when you see it.

- Retirement for rent: The emergence of new players and new models in the retirement housing sector, backed up by a structural imbalance in demand and supply underpins this year’s residential investment pick

- Partnerships with an affordable twist: While delivering a new generation of new towns is a laudable aspiration, the timescales, trials and tribulations involving in bringing these into being suggests it remains one for the evangelists. With a shift in focus to the delivery of affordable homes in the event of a change in government, we expect to see more partnerships between developers an affordable housing providers, especially the new generation of “for profits”.

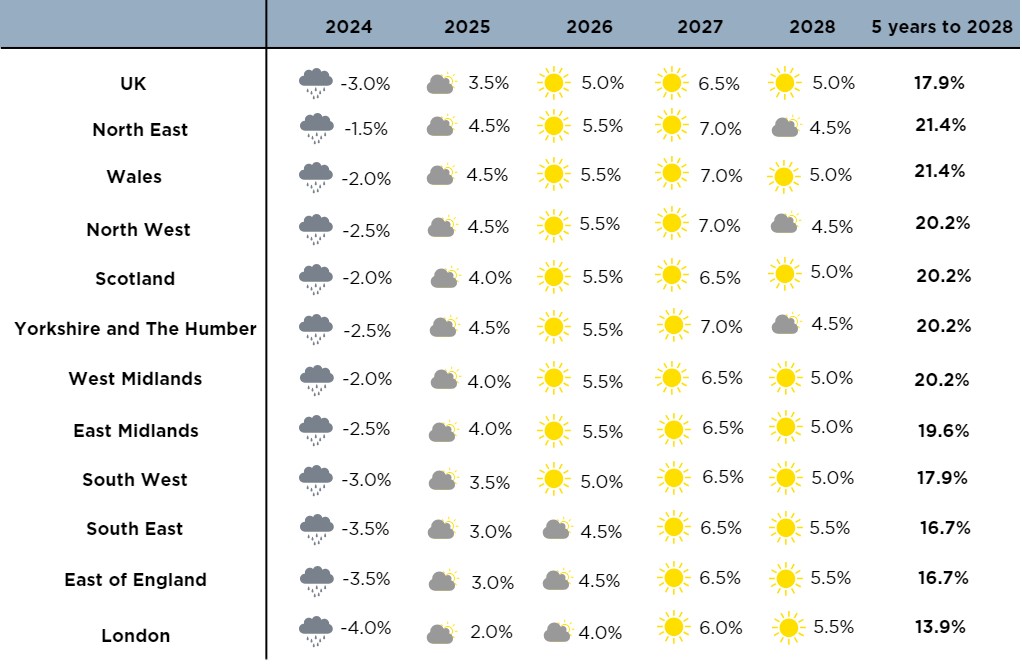

Savills’ 5-year property Forecast – As at 29-01-24:

Source: Savills

NB: These forecasts apply to average prices in the second hand market. New build values may not move at the same rate.

- 2023 prediction: -5%

- 2024 prediction: +3% (Revised from their 2024 prediction in October of -4%)

- Expects double-digit %age increase in sales volumes in 2024 compared to last year.

- Cumulative growth of 20.5% by 2028

“The best five-year, fixed-rate mortgage rate is now under 4%, which was made possible after the five-year swap rate fell a full percentage point over the final quarter of 2023. As a result of this more positive backdrop, we have revised our UK house price forecasts from three months ago.

“How long the current momentum in the housing market continues depends to some extent on when the general election takes place. There is a risk that Rishi Sunak can’t fully control the timing if ideological splits in his party on the issue of immigration grow wider, which adds an element of uncertainty.

”Speculation over the stability of the government is not good for sentiment in the housing market, as we saw in 2019 under former prime minister Theresa May.”

- 2023 prediction: -6%

- 2024 prediction -3%

“We anticipate a bottoming out of prices in mid-2024 but falls earlier in the year are expected to outweigh any second-half increases, resulting in single-digit annual falls by the end of 2024. Forecasts for 2025 and beyond predict a return to growth as we see more competitive fixed rates deals enter the market.”

According to the forecasters…

- 2023 prediction: -8%

- 2024 prediction -1.5%

“Large downward shifts in interest rate expectations mean that mortgage rates will continue to fall for the next month or two. That will support some recovery in activity and means that price declines are behind us for now at least.

“As we expect the Bank of England to wait longer than other major central banks to reduce interest rates, we expect mortgage rates to stabilise in early 2024. As we also forecast unemployment will rise, we think that, following a 2.5% drop in 2023, house prices will fall by 1.5% in 2024. However, if recent declines in market rates continue, further house price falls could well be avoided altogether.”

THE OFFICE FOR BUDGET RESPONSIBILITY

- 2023 prediction: -9%

- 2024 prediction -4.7%

- In the second quarter of 2023, housing transactions fell to their lowest level since the middle of the pandemic, as higher mortgage rates reduced housing affordability,’ it noted.

- Leading indicators suggest the market will remain weak … (and) residential property transactions are expected to fall as the housing market continues to cool.

- ‘We expect housing transactions to fall by 6.9 per cent in 2024, a 1.9 percentage point steeper decline than in our March forecast of 5 per cent.

- ‘We then expect housing transactions to steadily return to growth from the final quarter of 2024, returning to pre-pandemic levels in the first quarter of 2027.

- ‘Our central forecast estimates that house prices will grow by 0.9 per cent in 2023 and then fall by 4.7 per cent in 2024.

‘This would be consistent with the price of the average UK home reaching a low of around £266,000 at its trough in the final quarter of 2024.

‘All in all, from their high in the fourth quarter of 2022 to their low in the final quarter of 2024, nominal house prices are expected to decline by 7.6 per cent (2.4 percentage points less than we expected in March).

‘We then expect house prices to recover slowly, reaching their late 2022 peak levels in the second half of 2027 and rising to 6.4 per cent above this level by the end of the forecast. The outlook for house prices is particularly sensitive to changes in interest rates and household income growth.’

THOSE PREDICTIONS AT A GLANCE:

| Year | 2023 | 2024 |

| RIGHTMOVE | -2% | -1% |

| ZOOPLA | -5% | -2% |

| SAVILLS | -10% | -3% |

| KNIGHT FRANK | -5% | +3% |

| JLL | -6% | -3% |

| CAPITAL ECONOMICS | –8% | -1.5% |

| THE OFFICE FOR BUDGET RESPONSIBILITY | –9% | -4.7% |

So how much credence can we put into price forecasts?

Remember we at CapitalStackers don’t forecast – we just draw together all the threads and explain what their figures represent and where they’re drawn from so that you can make your own mind up.

And to be honest, we’re glad we don’t have to produce a forecast, because forecasters have plenty of form in getting predictions wrong. Cast your mind back to the start of the pandemic, where pessimism went as deep as a 16% fall – only for the Govt to step in and ignite the market with the Stamp Duty Holiday.

Following the outbreak of Covid-19 – with the property industry effectively shut down – it seemed perfectly logical to assume prices would plummet. Then along came the war, the oil crisis…

But of course, these predictions did not account for the huge positive influence of furlough support or the stamp duty holiday. Neither could they predict the huge swell in the value people placed on their homes, and space (particularly outdoor space) once they began spending more time in them. As people’s needs changed, so moving house became more of a priority, leading to a rise in property values of 8.5% in 2020, according to the ONS.

So the lesson seems to be: don’t bet against the optimism of the great British public – nor how much their homes mean to them.

The property market regularly defies all expectations and every time the sun comes up, we can expect another revolution of the economic tombola.

You can’t bet on higher interest rates becoming the new normal either, with inflation on course to settle down to the Bank of England’s arbitrary 2 per cent target or less. Nor are we guaranteed to enter a recession. Also, who’s to say that a competitive market won’t push mortgage rates down further than expected.

Only in the last week, we had Propertymark wailing that “a drop in house prices is ‘inevitable’ following the latest inflation figures”, and then just four days later, the soothing tones of Ernst and Young reassuring us that “victory in the fight over inflation will boost economic growth and house prices this year”, and upgrading its forecast from a 4% drop to a flat year.

And so the rollercoaster continues, with different voices quoting different sources, drawn from different figures, based on different timelines.

And don’t forget that there’s a general election on the horizon, which may prompt the Government to create another stamp duty holiday or launch another scheme to give first-time buyers a leg-up onto the ladder.

Which is why you’ll see such a wide variation between the predictions at the moment. Of the latest crop, the most pessimistic forecast is a -4% drop. Some, however, say the fall will be just -2% and there are even some saying we can look forward to growth.

So we’ll leave the final word toSavills’ Residential Research Associate, Nicholas Gibson:

“Our analysis suggests that we have been in the late stages of the housing market cycle since 2018, where London underperforms the UK average, and more affordable markets lead the way. Over the last five years, the ratio between UK and London house prices has been falling, albeit at a more gradual pace than in previous cycles.

“We expect this trend to continue over the next four years, but with UK and London performance slowly converging. The inflection point is likely to be reached in 2028, where the London v UK ratio will have fallen as far below the long term trend as it has in previous cycles. From this point, we expect to move into the next phase of the market cycle. London will once again lead price growth across the UK, driven by underlying population pressure, and a stronger economic outlook compared to the rest of the UK.”

POSTSCRIPT

Since putting this report together, Rightmove, Nationwide and Halifax have all released figures for January 2024.

Rightmove reported that the average new seller asking prices rose by 1.3% (+£4,571) month-on-month to £359,748, “the biggest December to January increase in prices since 2020, though average prices are still -0.7% lower than at this time last year”.

For the first week of the year, they put the number of new properties coming onto the market at 15% higher than in the same week last year – outpacing the rise in demand – while buyer demand was up 5% and sales agreed were up 20% “indicating a strong return of buyer confidence when compared with the unsettled post-mini-Budget period a year ago”.

A spokesman said: “There has been some tentatively promising activity in the first week of the year, markedly stronger than a year ago, as more prospective buyers and sellers seem to have the confidence to get their 2024 moving plans started early:

According to Halifax, the average house price rose in January for the fourth consecutive month – to £291,029. This was up +1.3% compared to December 2023, or £3,785 in cash terms, and brings the pace of annual growth to +2.5% – the highest since January last year.

Kim Kinnaird, Director of Halifax Mortgages, said:

“The recent reduction of mortgage rates from lenders as competition picks up, alongside fading inflationary pressures and a still-resilient labour market has contributed to increased confidence among buyers and sellers. This has resulted in a positive start to 2024’s housing market.

“Looking ahead, affordability challenges are likely to remain and further modest falls should not be ruled out, against a backdrop of broader uncertainty in the economic environment.”

Nationwide put the monthly increase at just 0.7%, with a fall of -0.2% for the year – bringing the average price to a more modest £257,656 – more than £33,000 lower than Halifax’s estimate and £102,092 below Rightmove’s.

Robert Gardner, Nationwide’s Chief Economist, said:

“There have been some encouraging signs for potential buyers recently with mortgage rates continuing to trend down. This follows a shift in view amongst investors around the future path of Bank Rate, with investors becoming more optimistic that the Bank of England will lower rates in the years ahead.

“These shifts are important as this led to a decline in the longer-term interest rates (swap rates) that underpin mortgage pricing around the turn of the year. However, the partial reversal in recent weeks in response to stronger than expected inflation and activity data cautions that the interest rate outlook remains highly uncertain.”

*Contains HM Land Registry data © Crown copyright and database right 2021. This data is licensed under the Open Government Licence v3.0.

Don’t invest unless you’re prepared to lose all your money. This is a high risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 minutes to learn more.