Where investors build on bank finance

Invest directly in property development alongside banks.

Double-digit returns

From just £2500 minimum investment

A unique service to investors and developers

Filling the funding gap between what banks are able to lend and what developers need to borrow.

P2P or not P2P? That is the question

CapitalStackers is P2P with added peace of mind.

Our model is based on working in close partnership with banks - NOT in competition to them - pooling information and sharing due diligence.

Working with banks means we can share information and double up on monitoring and risk analysis, which we carry out both jointly and separately.

It also gives investors certainty that each project will reach completion – since we insist all construction funding is in place before a penny of our investors’ cash is released.

Why invest through CapitalStackers?

Invest in partnership with banks

Secured on real estate

All projects fully funded from the outset – we don’t allow work to start or release a penny from investors until all funding required to complete the building work is in place – so there’s no question of having to attract new investors down the road.

Authorised and regulated by the FCA

Complete transparency and regular reporting. CapitalStackers makes understanding risk clear and simple, with plain-speaking online presentations, and fully-populated dashboards – giving you the means to monitor your investments, and be fully aware of your risk exposure at any time so you can make intelligent, mature and informed decisions.

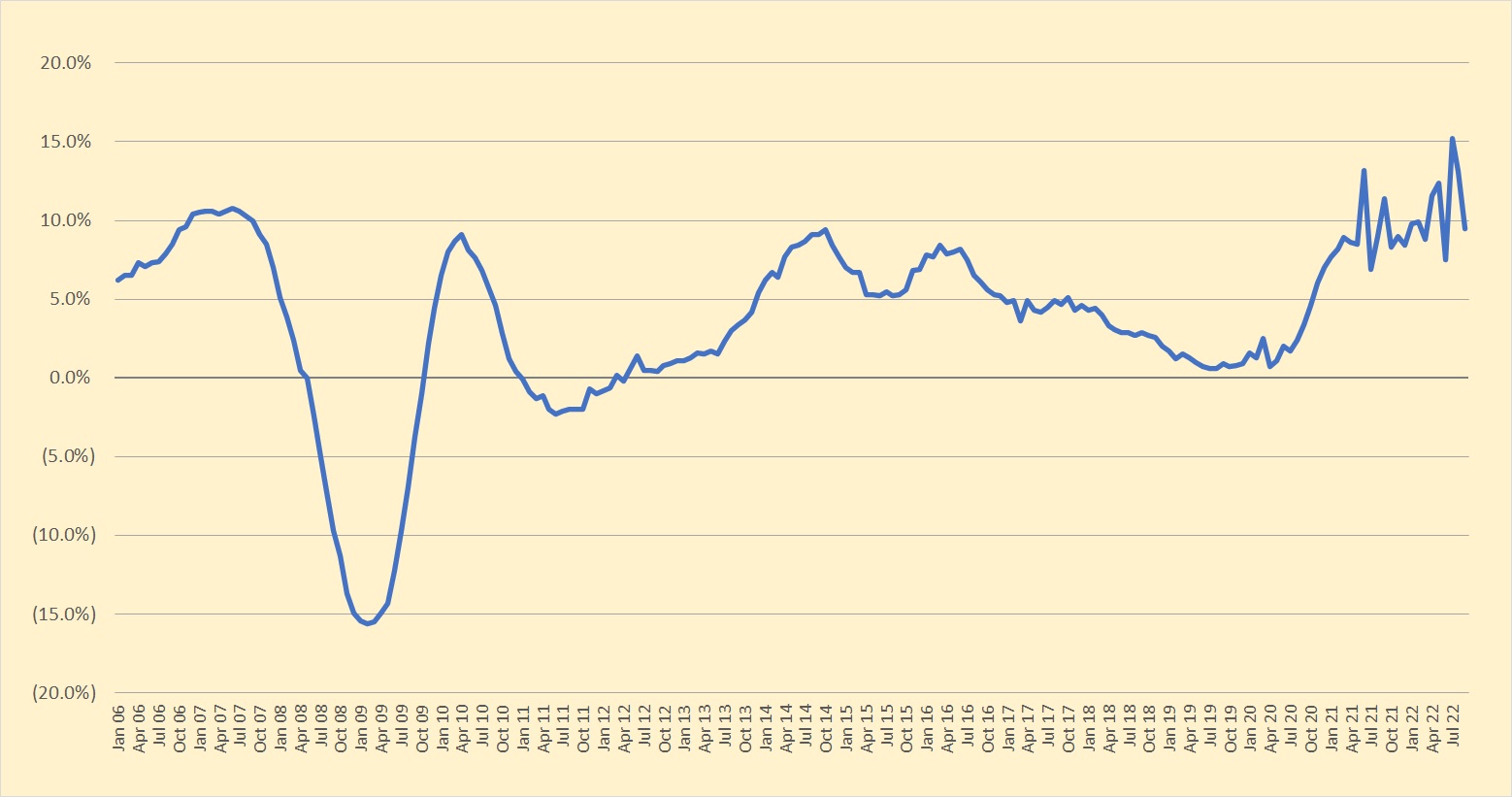

What the figures tell you

£258.0m raised

£154.3m repaid

£15.9m still working for investors

Average return primary market 8.47% p.a.

Highest return primary market 22.21% p.a.

Highest return secondary market 87.08% p.a.

Capital provisions (current book) 3.08%

Capital written off (historic loans) 10.85%

From the blog

The property crash that wasn’t

CapitalStackers

Knowing which way the wind is blowing

Steve Robson

Access denied

CapitalStackers